New Year's Resolution: Make a Real Difference

Perhaps your resolution is not to get a six pack by Valentine’s Day. Perhaps you aim to make a greater difference and get involved in your community in these current times of change. If so, consider an investment resolution with One Percent for America (OPA).

Why citizenship loans?

At OPA we are removing the barriers to citizenship, one immigrant at a time, through our community lending 1% interest loan to pay for USCIS fees. Why does citizenship matter? Because there are 9 million eligible immigrants who have not completed their USICS process, due in part to these application fees.

Through our original, independent survey research of over 1,200 immigrants nationwide we identified that 88% of noncitizen respondents said they are “extremely interested/very interested” in becoming a US citizen. The two top challenges among all respondents are the length of application process and the citizenship application fees. To support their citizenship dream, 87% of recently naturalized citizens borrowed funds from friends, family, or high-interest credit to pay for their citizenship fees, and 97% of noncitizens said they would consider borrowing funds. These are people you may already know, eligible immigrants who have lived in the U.S. for years and are art of your community, who have local businesses, children and families.

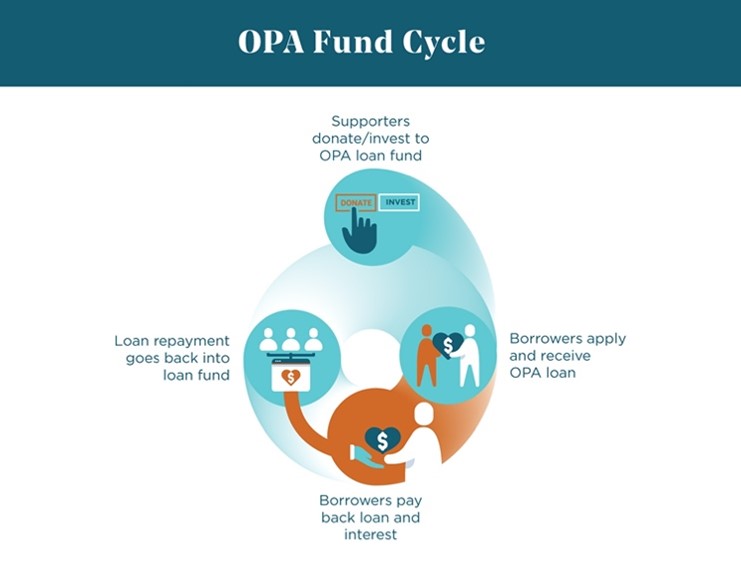

There is a bang for your dollar every time you invest with or donate to OPA. Our simple concept allows donated dollars to be used repeatedly- as immigrants pay back their loans, the dollars are used again to support additional immigrants with more 1% interest loans.

Immigration loans are still needed

Since immigration is the foundation of our country, allowing hard-working, deserving and eligible immigrants to achieve citizenship is the American way.

The U.S. also needs immigrants to stay competitive and drive economic growth. Immigrants are innovators, job creators, and consumers with an enormous spending power that drives our economy and creates employment opportunities for all Americans.

Our second national survey showed that immigrants don’t utilize the same financial products and cannot achieve the same goals as citizens do because of their status. These goals are basic: getting auto financing, getting an education loan, a business loan, or a mortgage loan. Goals that are an untapped market for the U.S. economy.

In terms of annual household income, most immigrant and U.S.-born citizens respondents in our survey reported a household income of $49,999 or lower. However, the immigrant population skewed slightly higher in income with 9% more being in the $70,000 - $199,999 income range. Even when earning the same as U.S.-born citizens, or slightly more, immigrants still depend on cash to reach the same financial goals.

Investing in citizenship therefore supports future consumers that will invest and strengthen the U.S. economy as well. Of all the resolutions you can make, investing in citizenship, changing a life, and supporting our country is a great resolution to achieve.